Related Document

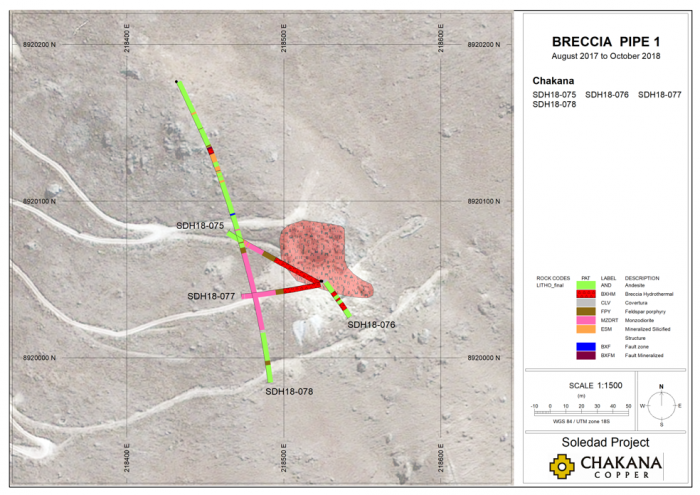

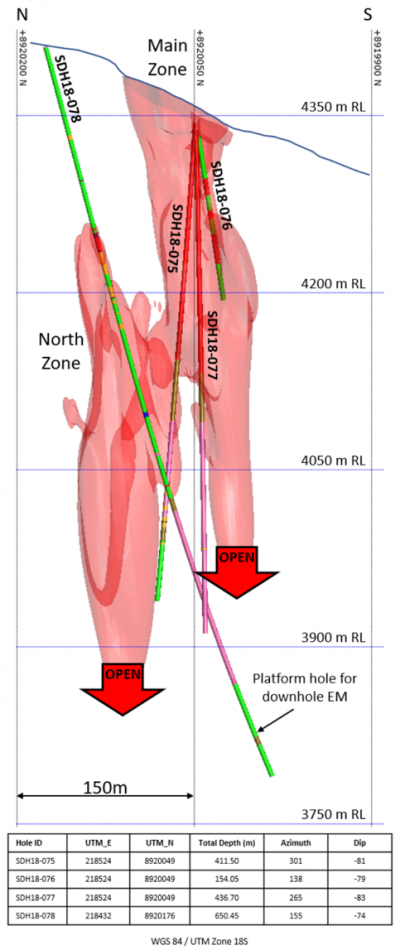

Vancouver, B.C., October 18, 2018 – Chakana Copper Corp. (TSX-V: PERU; OTC: CHKKF; FWB: 1ZX) (the “Company” or “Chakana”), is pleased to announce it has completed infill drilling on the upper 450m mineralized extent of Breccia Pipe 1 (Bx 1) at the Soledad copper-gold-silver project in central Peru. All drilling to date has been on the portion of the Soledad Project optioned from Condor Resources Inc. Results of the previous fifty-eight drill holes have been released and are also available at www.chakanacopper.com. Two of the holes reported here were designed to explore the western extent of the Main zone, one was designed to penetrate the southern limit of the Main zone, and one (SDH18-078) was drilled outside and parallel to the breccia pipe to serve as a platform hole for a down-hole electromagnetic (EM) survey intended to more accurately identify drill targets extending beyond 450m depth (Figs. 1 and 2).

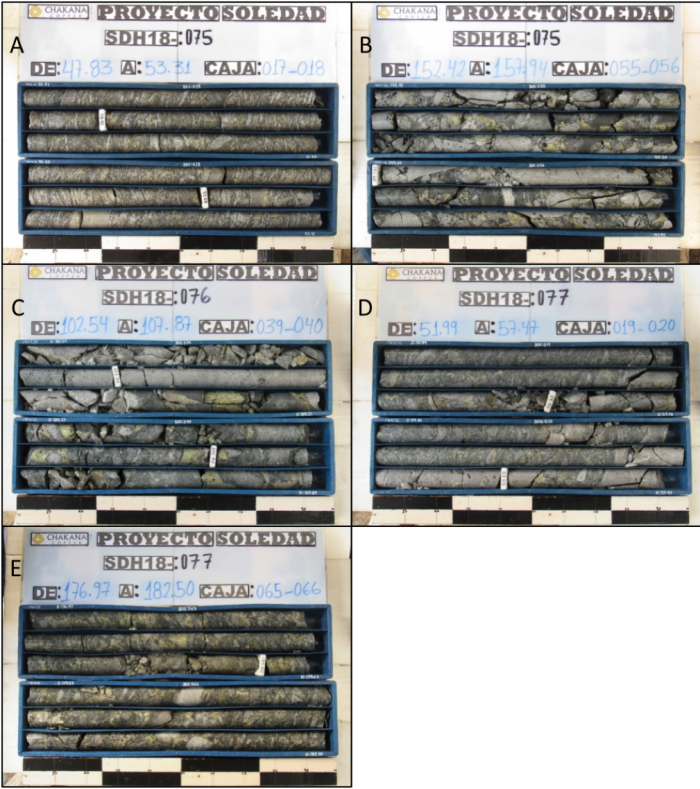

The two holes that test the western limit of the Main zone intersected thick intervals of mineralized breccia. Drill hole SDH18-075 intercepted 102m with 0.75% Cu, 3.77 g/t Au and 55.9 g/t Ag (3.69% Cu_EQ; 5.65 g/t Au_EQ) and hole SDH18-077 intersected 244m with 0.91% Cu, 1.41 g/t Au and 55.6 g/t Ag (2.31% Cu_EQ; 3.53 g/t Au_EQ) before each hole exited the breccia pipe. “The results of these latest holes have identified mineralization consistent with the previous results released for Bx 1 and demonstrate the high-grade nature of the mineralized breccia pipe” states David Kelley, President and CEO. Examples of mineralized breccias from holes in this release are shown in Figure 3.

New mineralized intervals from Breccia Pipe 1 are:

| Bx #1 - Main and North Zone Targeted Holes | |||||||||||

| DDH # | Az | Dip | From - To (m) |

Core Length (m) |

Au g/t |

Ag g/t |

Cu % | Cu-eq %* |

Au-eq g/t* |

Note | |

| SDH18-075 | 301 | -81 | 0.00 | 102.00 | 102.00 | 3.77 | 55.9 | 0.75 | 3.69 | 5.65 | Main zone |

| including | 0.00 | 40.00 | 40.00 | 4.19 | 31.5 | 4.60 | Oxide | ||||

| including | 40.00 | 102.00 | 62.00 | 3.50 | 71.7 | 1.22 | 4.12 | 6.30 | Main zone | ||

| and | 138.00 | 207.00 | 69.00 | 0.77 | 106.5 | 1.62 | 3.03 | 4.64 | Main zone | ||

| and | 316.80 | 345.70 | 28.90 | 0.44 | 44.5 | 1.86 | 2.53 | 5.87 | |||

| SDH18-076 | 138 | -79 | 0.00 | 15.00 | 15.00 | 4.40 | 38.0 | 4.90 | Oxide | ||

| and | 50.00 | 62.00 | 12.00 | 1.74 | 5.6 | 1.81 | Main zone | ||||

| and | 103.80 | 116.16 | 12.36 | 0.76 | 116.2 | 2.37 | 3.86 | 5.90 | Main zone | ||

| SDH18-077 | 265 | -83 | 0.00 | 244.00 | 244.00 | 1.41 | 55.6 | 0.91 | 2.31 | 3.53 | Main zone |

| including | 0.00 | 50.00 | 50.00 | 1.68 | 17.7 | 1.91 | Oxide | ||||

| including | 50.00 | 244.00 | 194.00 | 1.34 | 65.4 | 1.13 | 2.57 | 3.92 | Main zone | ||

| SDH18-078 | 155 | -74 | 218.83 | 225.70 | 6.87 | 4.43 | 455.4 | 1.14 | 7.93 | 12.13 | |

* Cu_eq and Au_eq values were calculated using copper, gold, and silver. Metal prices utilized for the calculations are Cu – US$2.90/lb, Au – US$1,300/oz, and Ag – US$17/oz. No adjustments were made for recovery as the project is an early stage exploration project and metallurgical data to allow for estimation of recoveries are not yet available. The formulas utilized to calculate equivalent values are Cu_eq (%) = Cu% + (Au g/t * 0.6556) + (Ag g/t * 0.00857) and Au_eq (g/t) = Au g/t + (Cu% * 1.5296) + (Ag g/t * 0.01307).

Reported mineralized intervals are not true widths given the vertical nature of the breccia pipe and the steep inclination of the holes.

Exploration Update

Infill drilling has been completed on Bx 1 and Bx 5; Bx 3E and Bx 6 are currently being evaluated with exploration drilling. Results from Bx 5, Bx 3E and Bx 6 are pending. The Company is waiting for the approval of its Semi-detailed Environmental Impact Study (EIA-SD) that will allow for additional platforms throughout the original Condor option area. This permit has received technical review approval and has progressed to the legal review stage. Delays in the receipt of the permit are a result of staff and management changes at the Ministry of Energy and Mines following the recent change in administration and our delays are consistent with those being experienced by other miners and explorers in Peru. Once approved, several additional high priority targets can be tested, including Bx 3W, Bx 7, and several altered areas consistent with being associated with mineralization seen in drilling. Upon receipt of the EIA-SD, a modification to the EIA-SD will be submitted to allow for exploration drilling on the mineral rights acquired to the south (see news release dated May 23, 2018 at www.sedar.com) covering the 200m long by 100m wide Huancarama Breccia Complex, the Paloma (East and West) pipes, and other breccia pipes and targets. This modification is expected to take 4-6 months for approval. Finally, a separate new permit, Declaration of Environmental Impact (DIA), will be submitted to allow for exploration drilling on breccia pipes and other targets in the Compañero cluster from the concessions recently optioned from Barrick (see news release dated July 16, 2018 at www.sedar.com). We anticipate the DIA permit being submitted in November, 2018.

“We are excited about the project advancement thus far and impatiently await approval of the EIA-SD permit that will allow several additional high priority targets to be tested upon receipt. Our team is ready to submit the modification that will provide access to the expanded mineral rights where several additional outcropping mineralized breccia pipes occur. In the meantime, we continue to drill with a single rig and are expanding our detailed surface mapping and rock and soil sampling across the broader 3,085 hectare land position that we have established. A second rig is on the property at no cost to the Company and can be deployed rapidly when access to the Huancarama and Paloma pipes is granted. There are 15 known breccia pipes on the combined property with an additional 15 high priority targets that may be blind breccia pipes. We also have a pending down-hole and surface EM survey throughout the expanded area of known breccia pipes that will help us further define and prioritize drill targets. The Company believes that this approach is fiscally prudent and ensures that the drilling is focused on prioritized, well-defined targets” added Mr. Kelley.

Sampling and Analytical Procedures

Chakana follows rigorous sampling and analytical protocols that meet or exceed industry standards. Core samples are stored in a secured area until transport in batches to the ALS facility in Callao, Lima, Peru. Samples batches include certified reference materials, blank and duplicate samplesthat are then processed under the control of ALS.All samples are analyzed using the ME-MS41 (ICP technique that provides a comprehensive multi-element overview of the rock geochemistry), while gold is analyzed by AA24 and GRA22 when values exceed 10 g/t. Over limit silver, copper, lead and zinc is analyzed using the OG-46 procedure.

Additional information concerning the Project is available in a technical report prepared in accordance with National Instrument 43-101 made available on Chakana’s SEDAR profile at www.sedar.com.

Qualified Person

David Kelley, an officer and a director of Chakana, and a Qualified Person as defined by NI 43-101, reviewed and approved the technical information in this news release.

ON BEHALF OF THE BOARD

(signed) “David Kelley”

David Kelley

President and CEO

For further information contact:

Michelle Borromeo, Manager – Corporate Communications

Phone:604-715-6845

Email: mborromeo@chakanacopper.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-looking Statement Advisory: This release may contain forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties, and other factors which may cause the actual results, performance, or achievements of Chakana to be materially different from any future results, performance, or achievements expressed or implied by the forward-looking statements. Forward looking statements or information relates to, among other things, the interpretation of the nature of the mineralization at the Project, the potential to grow the Project, the potential to expand the mineralization, the planning for further exploration work, the ability to de-risk the potential exploration targets, and our belief about the unexplored parts of the Project. These forward-looking statements are based on management’s current expectations and beliefs but given the uncertainties, assumptions and risks, readers are cautioned not to place undue reliance on such forward- looking statements or information. The Company disclaims any obligation to update, or to publicly announce, any such statements, events or developments except as required by law.

Figure 1 – Map showing drill holes with geology discussed in this release.

Figure 2 – Section looking east showing the Main and blind North breccia bodies at Bx 1 highlighting holes in this release. Light red 3D shapes based on Leapfrog model of breccia from all holes drilled by Chakana. Drill holes show tourmaline breccia (red), andesitic wall rock (green), and other host rocks (other colors). Section includes data from 50m in front of and behind section.

Figure 3 – Mineralized intercepts from drill holes reported in this release showing different styles of mineralization in Bx 1: A) SDH18-075 – high-grade shingle breccia from the Main Zone; the interval 47-53m assays 8.54 g/t Au, 1.97% Cu, and 15.3 g/t Ag; B) SDH18-075 – mosaic breccia from the Main Zone; the interval 152-158m assays 0.54 g/t Au, 2.39% Cu, and 119.2 g/t Ag; C) SDH18-076 –mosaic breccia from the Main Zone; the interval 103-108.5m assays 0.98 g/t Au, 4.87% Cu, and 100.4 g/t Ag; D) SDH18-077 – chaotic shingle breccia from the Main Zone; the interval 52-57m assays 8.81 g/t Au, 2.71% Cu, and 186.6 g/t Ag; E) SDH18-077 – mosaic breccia from the Main Zone; the interval 177-182m assays 2.35 g/t Au, 4.33% Cu, and 95.1 g/t Ag.